Local law 97

Local Law 97 (LL97) is a critical environmental regulation enacted in New York City aimed at combating climate change by reducing greenhouse gas emissions from large buildings. It sets stringent annual carbon emissions limits for buildings over 25,000 square feet and mandates reporting of energy usage and emissions. Building owners must take measures to improve energy efficiency and meet these limits, making LL97 a key component of the city’s sustainability efforts.

Navigating Compliance Excellence

Discover unparalleled Local Law 97 services tailored to propel your building towards emissions compliance and sustainability goals. Our specialized expertise in emissions calculations, reporting, and strategic consulting ensures your property is prepared for a low-carbon future. Partner with us to champion environmental responsibility while achieving regulatory success.

Local Law 97 Compliance Pathways:

The Standard Pathway mandated by Local Law 97 sets carbon emissions limits for individual properties, necessitating annual demonstrations of emissions falling below these thresholds. Infractions exceeding the limit incur penalties, with a fine of $268 per ton of CO2e. Initially, only 25% of buildings are subject to fines, a figure that escalates to 75% by 2030. Over time, emissions limits tighten progressively, targeting zero emissions by 2050. The baseline year is 2024, with annual reporting obligations commencing from May 2025.

Type of covered buildings:

Article 320 / 1 RCNY §103-14, Building Energy and Emissions Limits:

– Single building > 25,000 GSF;

– Multiple buildings, either on the same tax lot or governed by the same condo board, which are in aggregate > 50,000 GSF (even if individual buildings are < 25,000 GSF).

Not covered until 2026:

– Buildings with at least one, but no more than 35%, rent-regulated dwelling units.

Article 321 / 1 RCNY §103-17, Energy Conservation Measure Requirements for Certain Buildings:

Buildings meeting the same size thresholds as Article 320 that:

– Are mainly used as the assembly space for a house of worship;

– Are certain categories of affordable housing

Under the Prescriptive Pathway, two options exist:

Pathway 1:

installing 13 prescribed measures by December 31, 2024, or reducing emissions below the 2030 limit by the same deadline, both necessitating no further actions in the future.

Pathway 2:

2026 Pathway: mirrors the Standard Pathway but grants buildings an additional two years before enforcement begins, with the baseline year set at 2026.

2035 Pathway: aligns with the Standard Pathway but extends the compliance commencement by 10 years, with the baseline year designated as 2035.

Local Law 97 (LL97),

enacted in New York City, is a groundbreaking environmental regulation designed to address climate change and significantly reduce greenhouse gas emissions associated with the city’s building sector.

Emissions Reduction:

LL97 sets stringent annual carbon emissions limits for buildings larger than 25,000 square feet. These limits are customized based on building type and occupancy, with the goal of substantially reducing emissions over time.

Reporting and Compliance:

Building owners are required to annually report their energy usage and carbon emissions to city authorities. Failure to meet the prescribed emissions limits can result in substantial financial penalties.

Offset Mechanisms:

LL97 offers building owners options for offsetting emissions, including the purchase of Renewable Energy Credits (RECs) or implementing approved emissions reduction measures.

Energy Efficiency Upgrades:

To achieve compliance, building owners may need to invest in energy-efficient retrofits and upgrades to building systems, such as heating, cooling, insulation, and lighting.

Phased Implementation:

The law is implemented in phases, with different emissions limits and reporting requirements for various building sizes and types. Compliance deadlines are staggered to allow for planning and execution.

Environmental Impact:

LL97 aligns with New York City’s commitment to reducing carbon emissions, combating climate change, and enhancing sustainability. The law recognizes the significant role that buildings play in the city’s overall greenhouse gas emissions profile.

Policy Innovation:

Local Law 97 represents an innovative approach to climate action by targeting emissions from buildings, a major contributor to urban carbon footprints, and serving as a model for other cities seeking to address similar challenges.

In summary,

Local Law 97 is a pioneering environmental policy that aims to make New York City’s building stock more energy-efficient, environmentally sustainable, and resilient to the impacts of climate change, while contributing to global efforts to reduce carbon emissions and combat the climate crisis.

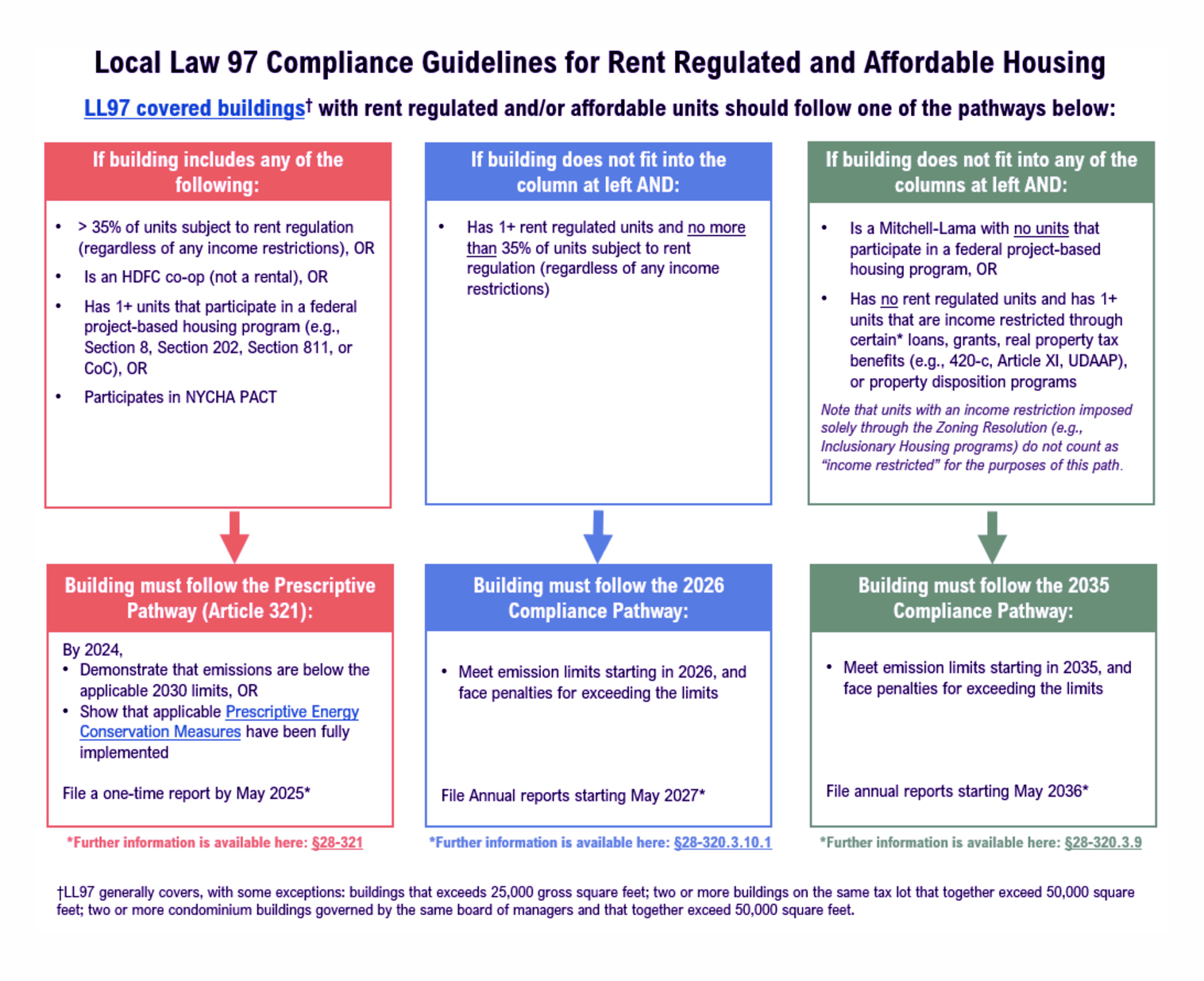

FAQs: Local law 97 Guidance for affordable housing

If a building contains at least one rent-regulated unit and no more than 35% of its units fall under rent regulation, the legislation mandates compliance with greenhouse gas (GHG) emissions limits. What does this entail?

According to LL97, buildings are allocated emissions limits that become increasingly stringent over time, determined by energy usage patterns. Buildings must undertake energy efficiency enhancements and other retrofits to ensure they remain within their emissions limits, or else face penalties. Buildings meeting the criteria of having at least one and no more than 35% of their units under rent regulation fall under Article 320.3.10.1 (2026 Pathway). This means they must adhere to emissions limits starting in 2026. The initial annual compliance report for such buildings is required by May 1, 2027.

What does the Prescriptive Pathway Compliance entail in LL97, and how does it impact affordable housing?

For buildings containing over 35% of rent-regulated units and certain other categories of affordable housing, LL97 offers compliance through either 1) staying within their designated emissions limits or 2) adhering to Article 321 (Prescriptive Pathway).

Under the Prescriptive Pathway, building owners must implement specific energy conservation measures by December 31, 2024.

If a building is owned by an HDFC and holds a project-based Section 8 contract, it should adhere to which compliance pathway?

For HDFC cooperative projects, the building falls under Article 321 (Prescriptive Pathway). Similarly, HDFC rental projects with a project-based Section 8 contract also follow Article 321 (Prescriptive Pathway).

If your building is an HDFC, which pathway does it fall under?

HDFC cooperative projects are always governed by Article 321.

HDFC rental projects could be subject to Article 321 (Prescriptive Pathway), Sections 320.3.10.1 (2026 Pathway), or 320.3.9 (2035 Pathway), depending on factors such as the presence and percentage of rent-regulated units or participation in federal project-based housing programs like project-based Section 8.

How are buildings solely benefiting from a 421-a exemption treated under LL97?

LL97 does not explicitly address buildings solely benefiting from 421-a tax exemptions. Owners must consider other building and unit characteristics, such as the number or percentage of rent-stabilized units, to determine the compliance pathway.

If over 35% of the building’s units are rent stabilized or if any unit participates in a federal project-based housing program (e.g., project-based Section 8), the Prescriptive Pathway should be followed.

If the building includes at least one rent-stabilized unit and no more than 35% of units are rent stabilized, the 2026 Pathway should be followed.

If the building lacks rent-stabilized units but is subject to income restrictions due to certain government loans, grants, disposition programs, or tax benefits (as per Section 320.3.9), the 2035 Pathway should be followed.

Typically, rental buildings benefiting solely from “old 421-a” (421-a(1-15)) adhere to the Prescriptive Pathway, as old 421-a requires all rental units to be rent stabilized. Rental buildings benefiting solely from “new 421-a” (421-a(16)) generally follow the 2026 Pathway, as new 421-a only mandates rent stabilization for affordable and market units below the vacancy decontrol threshold. Homeownership buildings with old or new 421-a alongside HPD/HDC loans and regulatory agreements featuring occupant income restrictions adhere to the 2035 Pathway. Homeownership buildings solely benefiting from 421-a (standalone 421-a) must comply with Article 320 starting in 2024 (2024 Pathway).

What are the LL97 compliance requirements for a Mitchell-Lama cooperative regulated by HPD and financed by HDC? Are Mitchell-Lamas exempt from LL97 penalties until 2035?

Mitchell-Lama cooperatives and rentals typically fall under Article 320.3.9 (2035 Pathway), necessitating compliance by 2035. However, if any units within a Mitchell-Lama building participate in a federal project-based housing program, it would be subject to Article 321 (Prescriptive Pathway) in 2024 instead of the 2035 Pathway.

If Mitchell-Lamas have rent-regulated units, will they need to comply with Article 321 and the ‘less/greater than 35% rent-regulated units’ requirement?

Pre-1974 Mitchell-Lama buildings are exempt from rent regulation, and a Mitchell-Lama housing company cannot be incorporated as an HDFC. Thus, Mitchell-Lamas would be subject to Article 321 (Prescriptive Pathway) only if they receive federal project-based assistance. Otherwise, they must adhere to Section 320.3.9 (2035 Pathway).

How do LL97 requirements work for HDFCs with 420-c, Article XI, or UDAAP?

HDFC cooperatives always fall under Article 321 (Prescriptive Pathway). HDFC rentals could be subject to Article 321 or Sections 320.3.10.1 (2026 Pathway) or 320.3.9 (2035 Pathway), contingent on factors such as the presence and percentage of rent-regulated units or participation in federal project-based housing programs like project-based Section 8. 420-c, Article XI, or UDAAP tax exemptions qualify HDFC rentals for the 2035 Pathway only if the building lacks rent-regulated units or participation in federal project-based housing programs. Refer to the provided flowchart for further clarification.

Is there a specific threshold of units requiring federal project-based assistance for a building to fall under Article 321, akin to the 35% requirement for rent-stabilized accommodations?

Any number of units receiving federal project-based assistance qualifies a building for Article 321 (Prescriptive Pathway). It’s important to note that tenant-based Section 8 vouchers do not count as federal project-based assistance.

Concerning Article 321 (Prescriptive Pathway), when can affordable housing commence all measures for LL97 compliance? Should they engage a design professional to verify compliance from the outset or after completing all measures?

Buildings are encouraged to initiate energy conservation measures as soon as feasible and maintain records from the outset of implementation. The Department of Buildings (DOB) will provide forthcoming rules and guidance documentation. Building owners should monitor the DOB website under “Resources” for updates in the upcoming year.

It’s important to note that for buildings implementing Article 321 prescriptive energy conservation measures, the compliance report must be filed by a Retro-commissioning Agent. Buildings reporting compliance with emissions limits under Article 321 are required to have their annual report certified by a registered design professional.

If a building undertakes electrification projects to reduce its use of fossil fuels, would this count for LL97 compliance?

Electrification alone wouldn’t qualify as a prescriptive energy conservation measure, but such projects could aid a building in meeting emissions limits outlined in Article 321.2.1 and Article 320.

How are renewable technology measures, such as solar, accounted for in LL97? How can a building demonstrate installation of a solar array as part of the Prescriptive Pathway under Article 321?

Solar isn’t listed among the prescriptive energy conservation measures, but onsite solar installations could decrease emissions and assist certain buildings in meeting emissions limits. This applies to an Article 321 building aiming to meet the 2030 emissions limits by 2024 or any building subject to a compliance pathway in Article 320. For buildings pursuing compliance via 321.2.1 (2024 Pathway), a report from a design professional confirming that the building’s emissions limits (with solar) fall below the 2030 limits must be submitted to the DOB by May 1, 2025.

The DOB will issue a Rule providing guidance on calculating renewable technology measures like solar for energy usage determination purposes.

Does the Prescriptive Pathway necessitate only one compliance report in 2025, or must building owners take additional steps after 2025?

As per the current language of Article 321, no further action is mandated once a building has implemented the necessary energy conservation measures and submitted a compliance report in 2025 to demonstrate adherence.

If a building receives tenant-based rental assistance (vouchers), is it subject to compliance under Article 321 (Prescriptive Pathway)?

Tenant-based vouchers are not tied to a specific building and therefore do not qualify a building for compliance under Article 321 (Prescriptive Pathway).

What if my project benefits from Low Income Housing Tax Credits?

LL97 does not specifically address buildings awarded Low Income Housing Tax Credits. Projects should refer to the provided guidance to ascertain compliance requirements.

What if my project incorporates Inclusionary Housing (IH) or Mandatory Inclusionary Housing (MIH)?

LL97 does not explicitly cover buildings with units subject to Inclusionary Housing. Merely having Inclusionary Housing does not automatically satisfy the requirements for meeting the Article 320 limits starting in 2035, as outlined in §28-320.3.9. Projects should consult the provided guidance to determine compliance obligations.

Can buildings subject to Article 321 (Prescriptive Pathway) seek exemption from implementing the required Prescriptive Energy Conservation Measures?

Buildings under Article 321 (Prescriptive Pathway) must execute the mandated prescriptive energy conservation measures and are ineligible for exemption. However, these buildings have the alternative of achieving the 2030 carbon emissions limits (320.3.2) by 2024 instead of pursuing the Prescriptive Energy Conservation Measures.

The emission limits vary for different occupancy groups. My building primarily serves as housing (i.e., a class A multiple dwelling) but includes ground floor retail stores. Which emissions limit applies to my building?

Emission limit calculations consider the combined area quantification for each property type.

What steps should be taken if the current building occupancy differs from what is indicated on our Certificate of Occupancy?

Building owners of covered buildings must annually submit a report, certified by a Registered Design Professional (RDP), regarding their compliance with applicable building emissions limits per LL97. The building’s RDP is responsible for determining the relevant Occupancy Groups based on forthcoming department rules.

Chapter 3 of the 2014 NYC Building Code offers specifics on each Occupancy Group.

The building’s Certificate of Occupancy serves as a reference for approved Occupancy Groups.

The Annual Building Emission Limit, calculated per Section 320.3, is based on the ACTUAL Occupancy Groups present in the building. If the actual occupancy differs from the Certificate of Occupancy, the ACTUAL occupancy should be documented.

Will specific information be available on which equipment is more energy-efficient for a building’s needs and/or assistance to complete the compliance report?

Programs such as the NYC Accelerator and other State and City initiatives can aid owners in identifying energy-efficient and carbon reduction measures to achieve LL97 compliance.

Clarifications on the Prescriptive Energy Conservation Measures:

Regarding pipe insulation, do I need to insulate pipes that are not visible or accessible?

Only accessible pipes are required to be insulated. Refer to 2020 NYCECC Section C503.1, C403.11.3, and C404.4.

How is “whole building insulation” defined and does this necessitate opening up cavities or adding roof insulation?

Buildings should add insulation to exposed cavities in roofs and walls integral to the building’s thermal enclosure, where feasible. See 2020 NYCECC Section C503.1, Exception #3.

Concerning “timers on exhaust fans,” could you clarify which types of exhaust fans are referred to?

This measure applies to intermittent-type exhaust fans not intended for use in a code-compliant continuously running ventilation system.

Are radiant barriers required behind all radiators (e.g., fin-tube baseboard heaters) or just freestanding cast-iron type radiators?

Radiant barriers should be installed behind equipment primarily heating a space by radiation (> 50%), such as steel, aluminum, and cast-iron panels (single and double), flat pipe (single and double), tubular type, and sectional radiators. This excludes fin-tube baseboard heaters and convectors. The intent is to avoid necessitating destructive work for radiant barrier installation.